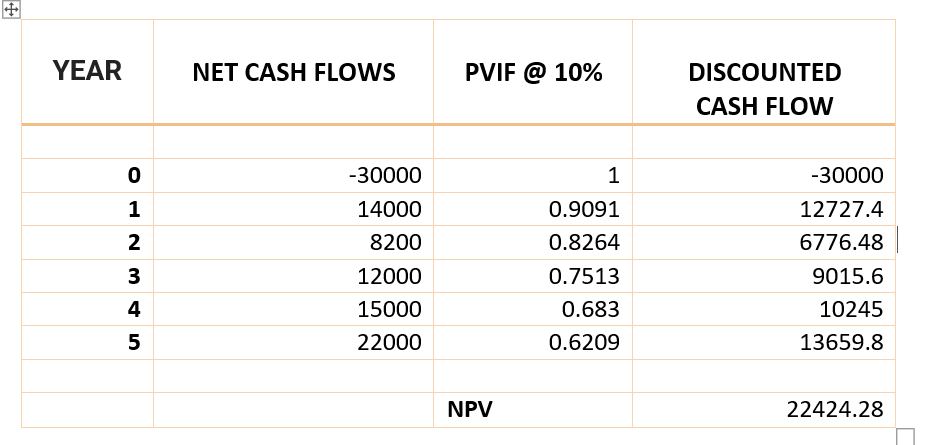

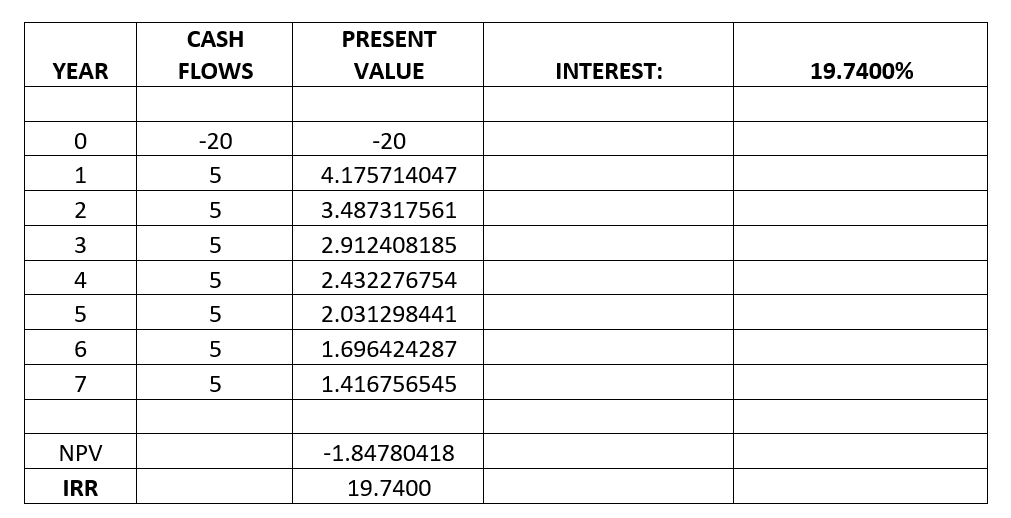

- Compute the NPV and IRR for project whose initial cost is 30,000 and cash inflows are 14000, 8200, 12000, 15000, 22000. Discount Rate is 10%. Cost of Capital if borrowed is 15%. Show value of NPV at IRR as discount factor. Based on the above calculations, should the project be considered?

SOLUTION:

The calculations are done in excel where NPV is calculated using time value of money and IRR value is found which is closest to NPV =0

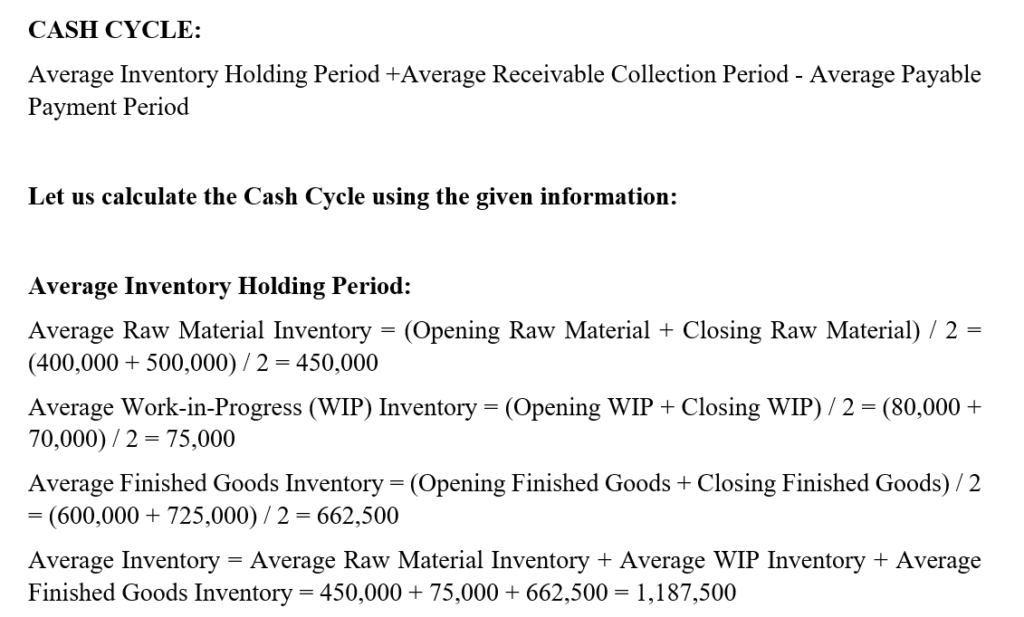

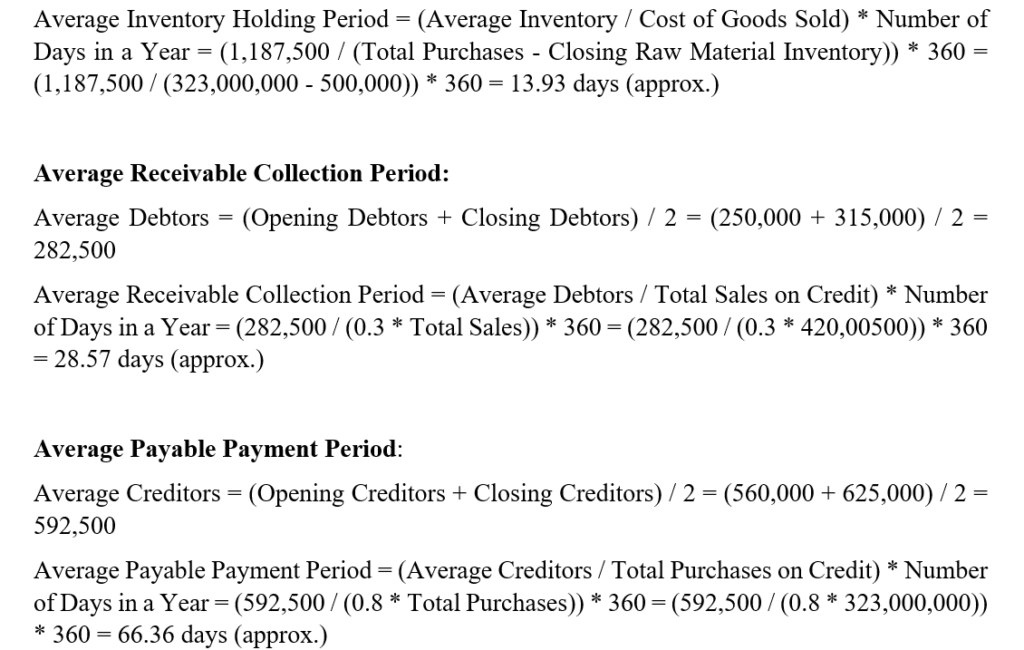

2. Calculate the Cash Cycle using the following information. (Assume 360 days in a year).

Opening Balances

Raw Material 4,00,000

WIP 80,000

Finished Goods 6,00,000

Debtors 2,50,000

Creditors 5,60,000

Closing Balances

Raw Material 5,00,000

WIP 70,000

Finished Goods 7,25,000

Debtors 3,15,000

Creditors 6,25,000

Costs Incurred during the year

Manufacturing Costs 10,45,000

Excise Duty 8,50,000

Selling and Distribution Expenses 4,20,000

Admin. Overheads 3,00,000

Total Sales 4,20,00,500

Total Purchases 3,23,00,000

30% of sales are on credit and 80% of purchases are on credit.

SOLUTION:

MBA | MMS | M Com | MHA | BBA | BCom| BMS | BHM | DIGITAL MARKETING CLASSES

TUITIONS | ASSIGNMENTS | ADMISSION

9748882085 | 7980975679