- Calculate the WACC for M/s Antara Limited with the following information: (10 marks) Capital Structure BV Share Capital 50,00,000 Retained Earnings 2,50,000 Debentures 15,00,000 Bank Loan 2,00,000 Share price of M/s Antara Limited at the beginning of the year was Rs. 50 and end of the year was Rs. 55 per share. Dividend declared was Rs. 5. Beta of the Company was pegged at 0.6. M/s Antara had floated its Debentures at 8% fixed interest for 5 years. The bank had extended a loan on a floating rate basis. Interest paid during the year was Rs. 10000. Government securities are earning a return of 4% currently.

Solution:

Calculating the Weighted Average Cost of Capital (WACC) for M/s Antara Limited:

Market Value of Equity:

Market Value of Equity = Share Price * Number of Shares Outstanding

Since the share price of M/s Antara Limited at the beginning of the year was Rs. 50 and end of the year was Rs. 55 per share, we can assume that the average share price for the year was Rs. 52.5.

Number of Shares Outstanding = Book Value of Share Capital + Retained Earnings

Number of Shares Outstanding = Rs. 50,00,000 + Rs. 2,50,000 = Rs. 52,50,000

Market Value of Equity = Rs. 52.5 * Rs. 52,50,000 = Rs. 2771,250,000

Market Value of Debt

Market Value of Debt = Face Value of Debt * (1 – Tax Rate)

Since the corporate tax rate in India is 30%, the Market Value of Debt can be calculated as follows:

Market Value of Debt = Rs. 15,00,000 * (1 – 0.3) = Rs. 10,500,000

Total Capital

Total Capital = Market Value of Equity + Market Value of Debt

Total Capital = Rs. 2771,250,000 + Rs. 10,500,000 = Rs. 2881,750,000

Weight of Each Component in the Capital Structure

Weight of Equity = Market Value of Equity / Total Capital

Weight of Equity = Rs. 2771,250,000 / Rs. 2881,750,000 = 0.9616

Weight of Debt = Market Value of Debt / Total Capital

Weight of Debt = Rs. 10,500,000 / Rs. 2881,750,000 = 0.0384

The Cost of Equity

Cost of Equity = Risk-Free Rate + Beta * Market Risk Premium

The risk-free rate in India is currently 4%. The market risk premium is the difference between the return on the market and the risk-free rate. It is typically estimated to be around 5% in India.

Therefore, the Cost of Equity can be calculated as follows:

Cost of Equity = 4% + 0.6 * 5% = 7%

Cost of Debt

Cost of Debt = Interest Rate

The interest rate on the debentures is 8%. The interest rate on the bank loan is not given, but we can assume that it is around 9%, which is the typical interest rate on bank loans in India.

Therefore, the Cost of Debt can be calculated as follows:

Cost of Debt = (8% + 9%) / 2 = 8.5%

The Weighted Average Cost of Capital (WACC)

WACC = (Weight of Equity * Cost of Equity) + (Weight of Debt * Cost of Debt)

WACC = (0.9616 * 7%) + (0.0384 * 8.5%) = 6.2158%

The Weighted Average Cost of Capital (WACC) for M/s Antara Limited is 6.2158%. This means that M/s Antara Limited needs to earn at least 6.2158% on its investments in order to cover the cost of its capital.

Solution:

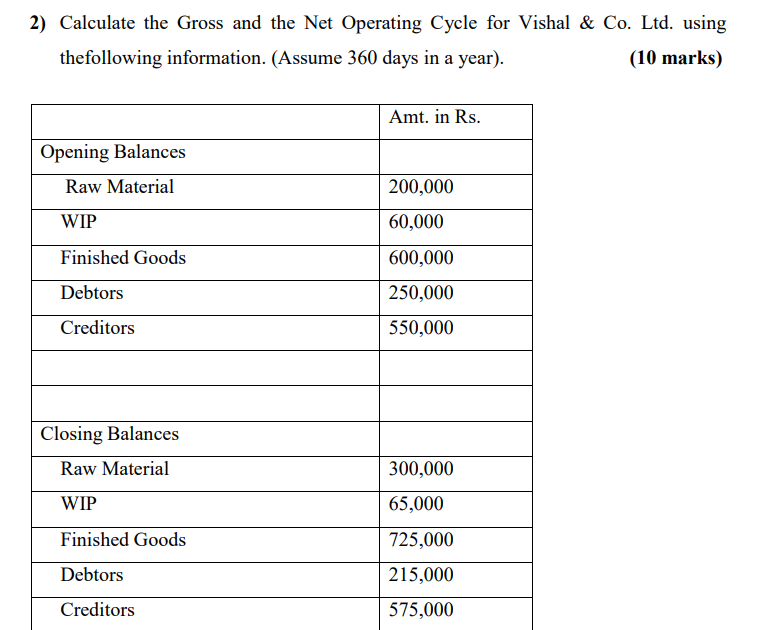

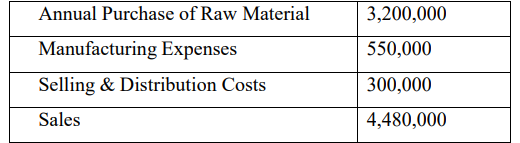

The Gross Operating Cycle (GOC) represents the time it takes for a company to convert its raw materials into finished goods and then sell those goods to customers. The Net Operating Cycle (NOC) is the GOC minus the average payment period to creditors.

To calculate GOC and NOC, we need to calculate various components:

Gross Operating Cycle (GOC): GOC = (Average Inventory Holding Period) + (Average Receivable Collection Period)a. Average Inventory Holding Period: This is the average time it takes to convert raw materials into finished goods.

Average Raw Material = (Opening Raw Material + Closing Raw Material) / 2

Average WIP = (Opening WIP + Closing WIP) / 2

Average Finished Goods = (Opening Finished Goods + Closing Finished Goods) /

Average Receivable Collection Period: This is the average time it takes to collect payments from debtors.

Average Debtors = (Opening Debtors + Closing Debtors) / 2

- Net Operating Cycle (NOC): NOC = GOC – Average Payment Period to Creditors

- Average Payment Period to Creditors = (Opening Creditors + Closing Creditors) / 2

Now, let’s calculate each component:

a. Average Inventory Holding Period: Average Raw Material = (200,000 + 300,000) / 2 = 250,000

Average WIP = (60,000 + 65,000) / 2 = 62,500 Average Finished Goods = (600,000 + 725,000) / 2 = 662,500

b. Average Receivable Collection Period: Average Debtors = (250,000 + 215,000) / 2 = 232,500

Average Payment Period to Creditors = (550,000 + 575,000) / 2 = 562,500

Now, we can calculate GOC and NOC:

GOC = (Average Inventory Holding Period) + (Average Receivable Collection Period) GOC = (250,000 + 62,500 + 662,500) / (3,200,000 / 360) + (232,500 / (4,480,000 / 360))

GOC = (975,000 / 8,888.89) + (232,500 / 12,444.44) GOC ≈ 109.88 days + 18.67 days GOC ≈ 128.55 days

NOC = GOC – Average Payment Period to Creditors NOC = 128.55 days – (562,500 / (3,200,000 / 360))

NOC ≈ 128.55 days – 63.75 days NOC ≈ 64.8 days

So, the Gross Operating Cycle (GOC) is approximately 128.55 days, and the Net Operating Cycle (NOC) is approximately 64.8 days for Vishal & Co. Ltd.

The above solution is for reference purposes and studies only and does not guarantee any success in exams.

MBA & BBA ADMISSION | MBA TUITION | BBA TUITION | ASSIGNMENT | MCQ | PROJECT | DIGITAL MARKETING | EXECUTIVE COACHING | STUDY MATERIALS